Back in July 2011 the so called Greek negotiating team made a rather fundamental error when negotiating the original PSI. They engaged into the talks apparently unprepared and with a rather amateurish team. The result was an agreement that was later abandoned and declared dead only to be replaced by another PSI that also seems to be dead too. The Greeks appeared to have made another mistake which only betrays severe incompetence in the matter. They signed a clause that allows countries (Finland) to ask for collateral from Greece as a prerequisite for their financial support. Why was it a mistake? Because there are Greek bonds in existence that specifically prohibit Greece from giving any security unless they do so for everybody. If they do not give this security to everybody, then it would be a breach of the bond's covenants and possibly an "Event of Default". The negotiating team could have said to the Finland team that they cannot possibly give these guarantees as this would be an event of Default, which is something to be avoided and the case would have been closed then and there. That would have been the case of course, if anyone had bothered to read the legal documents that the Hellenic Republic had already signed (see FT alphaville).The fact that they did not object to it, shows that they had not done their homework going into a meeting that was to shape the country's future. Incidentally, for Bond aficionados the actual clause is called a "Negative Pledge". Let me give you an example from the Greek bond with ISIN XS0256563429.

|

| Click to enlarge |

"So long as any Note remains outstanding, the Republic shall not create or permit to subsist any mortgage, pledge, lien or charge upon any of its present or future revenues, properties or assets to secure any External Indebtedness, unless the Notes shall also be secured by such mortgage, pledge, lien or charge equally and rateably with such External Indebtedness or by such other security as may be approved by an Extraordinary Resolution of the Noteholders (as described in Condition 10)."

So simply by reading the Offerings of the bonds they could have avoided a lot of trouble and the subsequent structuring of a special vehicle to handle this guarantees. Absurdly enough the Greek side seems to be repeating the mistake! (Τό δίς ἐξαμαρτεῖν οὐκ ἀνδρός σοφοῦ, "To commit the same sin twice is not a sign of a wise man.")

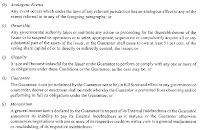

Greece negotiating directly the PSI could be an event of default.

|

| Click to enlarge |

"(l) Moratorium

A general moratorium is declared by the Guarantor in respect of its External Indebtedness or the Guarantor announces its inability to pay its External Indebtedness as it matures or the Guarantor otherwise commences negotiations with one or more of its respective creditors with a view to a general readjustment or rescheduling of its respective indebtedness."

The Guarantor in this case is the Hellenic Republic and the bond was issued by the Hellenic Railways. Interestingly, apart from the Greek lawyers (that may claim ignorance), the international one is a very well known firm, that should have spotted this gross mistake in the Offering.

One could have stretched the argument up

until now by claiming that it was the IIF that was doing the negotiations and

not Greece directly. This is like hiding behind a fig leaf. But if it is true

that Greece is now directly negotiating the "voluntary" restructuring

and haircut and it would leave very little room for latent interpretations. Ultimately,

it would be up to the English courts to decide how to construe it.

One thing is

certain, the market is scrutinizing Greece’s every move and Greece would better

square up to it (see FT alphaville). All one has to do, is to buy few thousands

(minimum denomination is 1000) of this bond maturing on 13 September 2012 and

go to an English court and declare that Greece has breached the covenants and

has therefore defaulted. Apparently it is that easy. I wonder how long it would

take before someone does this.